Argentina's Currency Board: The Mirage of Stability and the Reality of Crisis

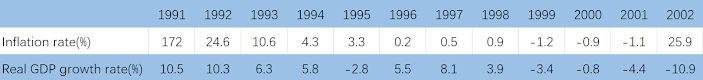

In 1991, after suffering two episodes of hyperinflation and a long-term economic recession, Domingo Cavallo, the Minister of Economy, implemented the Convertibility Plan in Argentina. The core of the plan is the "currency board," a fixed exchange rate mechanism that pegged the Argentine peso to the US dollar at a one-to-one rate of exchange, and the money supply could only be increased through the central bank's hard currency reserves, thereby constraining monetary policy. Argentina believed that the currency board would address the long-standing problem of inflation. But Convertibility was more like an extreme response to hyperinflation. While successful in reducing Argentina's inflation rate in the early stages of implementation, it was later found to be unsustainable.

|

Argentina’s Economic Performance,1991-2002 |

The recession began in 1998 and worsened by

2001. Due to the strong dollar policy of the US and Argentina's inflexible

monetary regime, the peso was overvalued. Convertibility as a monetary straitjacket,

the country fell into a currency-growth-debt trap and crisis in 2002 when it

was unable to repay its external debts. The government was forced to default on

its loans, and the peso depreciated, leading to sharp economic contraction,

rising unemployment, and social unrest. This crisis caused widespread protests,

government resignations, and long-term economic instability.

|

A Cartoon on Argentina's Sovereign Debt Crisis |

Comments

Post a Comment