A chaotic denouement

Years of accumulated and worsening economic and political problems, compounded with adverse external conditions, gradually eroded confidence in the Convertibility Plan, which fixed the exchange rate between the Argentine peso and the US dollar. The Fairness of impending devaluation and realizing that there were not enough US dollars in the banking system to pay all deposits, led to a capital flight. Bank runs erupted, and the economic recession evolved into an economic crisis. According to CW Calomiris, Argentina's collapse differed from previous financial crises in emerging markets. In Argentina, the government used the reserves of the entire banking system, and the fiscal weakness resulted in banking weakness. In other crises, the weakness of the banking system created the expectation of future fiscal problems, and the government would have to bailouts failing banks.

|

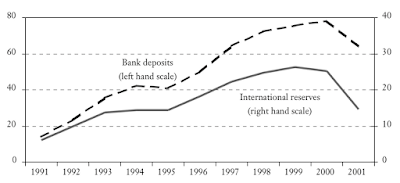

Bank deposits and international reserves(in

billion of dollars) |

On December 1st, the Argentine government was forced to implement the "corralito", a form of capital control that limited the amount of cash that could be withdrawn from bank accounts to 250 pesos per week and restricted the transfer of money abroad. These measures were designed to prevent a further drain on the country's already depleted foreign currency reserves and to stabilize the financial system. However, they ultimately led to widespread dissatisfaction and anger among the population, resulting in nationwide riots and demonstrations.

|

| pot-banging protests |

Finally, with the devaluation in January 2002, the convertibility regime was discarded outright. The direct macroeconomic consequences of the crisis were severe. The unemployment rate rose to over 18%, and the public debt ratio to GDP was about 135%. Argentina, once known as the world's breadbasket, suffered from widespread hunger and malnutrition, with the number of people living in poverty rising to 14 million, nearly one-third of the total population.

Comments

Post a Comment