A chaotic denouement

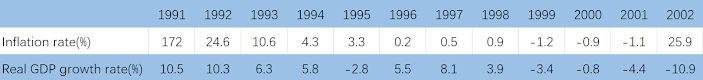

Years of accumulated and worsening economic and political problems, compounded with adverse external conditions, gradually eroded confidence in the Convertibility Plan, which fixed the exchange rate between the Argentine peso and the US dollar. The Fairness of impending devaluation and realizing that there were not enough US dollars in the banking system to pay all deposits, led to a capital flight. Bank runs erupted, and the economic recession evolved into an economic crisis. According to CW Calomiris , Argentina's collapse differed from previous financial crises in emerging markets. In Argentina, the government used the reserves of the entire banking system, and the fiscal weakness resulted in banking weakness. In other crises, the weakness of the banking system created the expectation of future fiscal problems, and the government would have to bailouts failing banks. Bank deposits and international reserves(in billion of dollars) On December 1st, the Argentine government wa...