Criticisms of the IMF

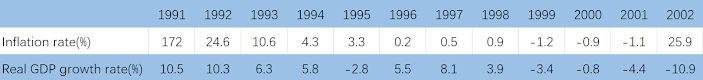

Blame should not be placed solely on Argentina. The IMF was not just a bystander in this crisis. While we acknowledge that Argentina is ultimately responsible for its policy decisions, the IMF is only one of the actors involved. The fact remains that the IMF supported Argentina's Convertibility Plan from 1991-2001. In fact, the Fund's Managing Director openly praised Argentina's economic policy as the "best in the world" during the IMF's Annual Meeting in 1998.

|

A demonstrator holds a placard that reads "IMF equals poverty" |

Criticisms of the IMF can be divided into three main areas. Firstly, the staff did not adequately warn of the dangers of Argentina's policies. The IMF should have played a supervisory role. However, either in 1998 when Argentina entered a recession or even earlier, the IMF failed to urge a modification of the exchange rate regime, and it was not until it was too late. With hindsight, as the IEO's analysis report pointed out, it would have been better to push for modifications to the peg's implementation more forcefully in the 1990s. The IMF lacked a forward-looking concept of exchange rate sustainability and failed to analyze the situation faced by Argentina. Secondly, it forced Argentina to adopt contractionary policies. In July 2001, the IMF demanded that Argentina implement the Zero Deficit Law, but the measures to stimulate demand were ineffective, causing a decline in production and business indices. Finally, the IMF provided a series of large loans to encourage continued poor policies but cut off funding when Argentina was already in economic distress, exacerbating the financial crisis. In November 2001, the IMF decided to terminate its loan payments to Argentina, citing Argentina's failure to achieve the target of reducing the fiscal deficit.

|

Comments

Post a Comment