Another cause: Weak fiscal policy

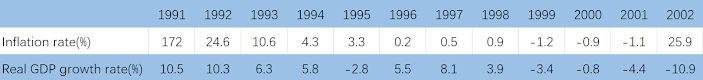

The decision of implementing the Convertibility Plan made the fiscal policy of Argentina crucial. With the constraints on monetary policy, the government needed to maintain low levels of debt to ensure the effectiveness of fiscal policy as a tool for macroeconomic management, and its ability to act as the lender of last resort. However, after the neoliberal reform, tax revenues decreased after the privatization of many state-owned enterprises. Furthermore, under the fixed exchange rate regime, Argentine exports became one of the most expensive in South America. With reducing fiscal revenues, foreign indebtedness became the primary channel for financing the balance of payments, maintain international reserves and sustaining the nominal value of the domestic currency. As a result, Argentina's public debt grew rapidly.

Given Argentina's history of sovereign debt defaults, S&P credit rating for Argentina was low, and the market questioned Argentina's fiscal solvency, forcing it to pay higher interest rates to borrow and increasing international pressures on its balance of payments. Most of Argentina's debt was denominated in dollars, which is known as the "original sin". This meant that once the Argentine peso devalued, the value of its liabilities would rise. This also became one of the reasons why Argentina was reluctant to abandon the fixed exchange rate when it became unsustainable. The announcement of the floating of the Argentine peso undoubtedly increased the burden of its debt.

|

| Argentina's Foreign debt, Current account and Budget balance, 1991-2000 |

Comments

Post a Comment